Life Insurance in and around San Diego

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

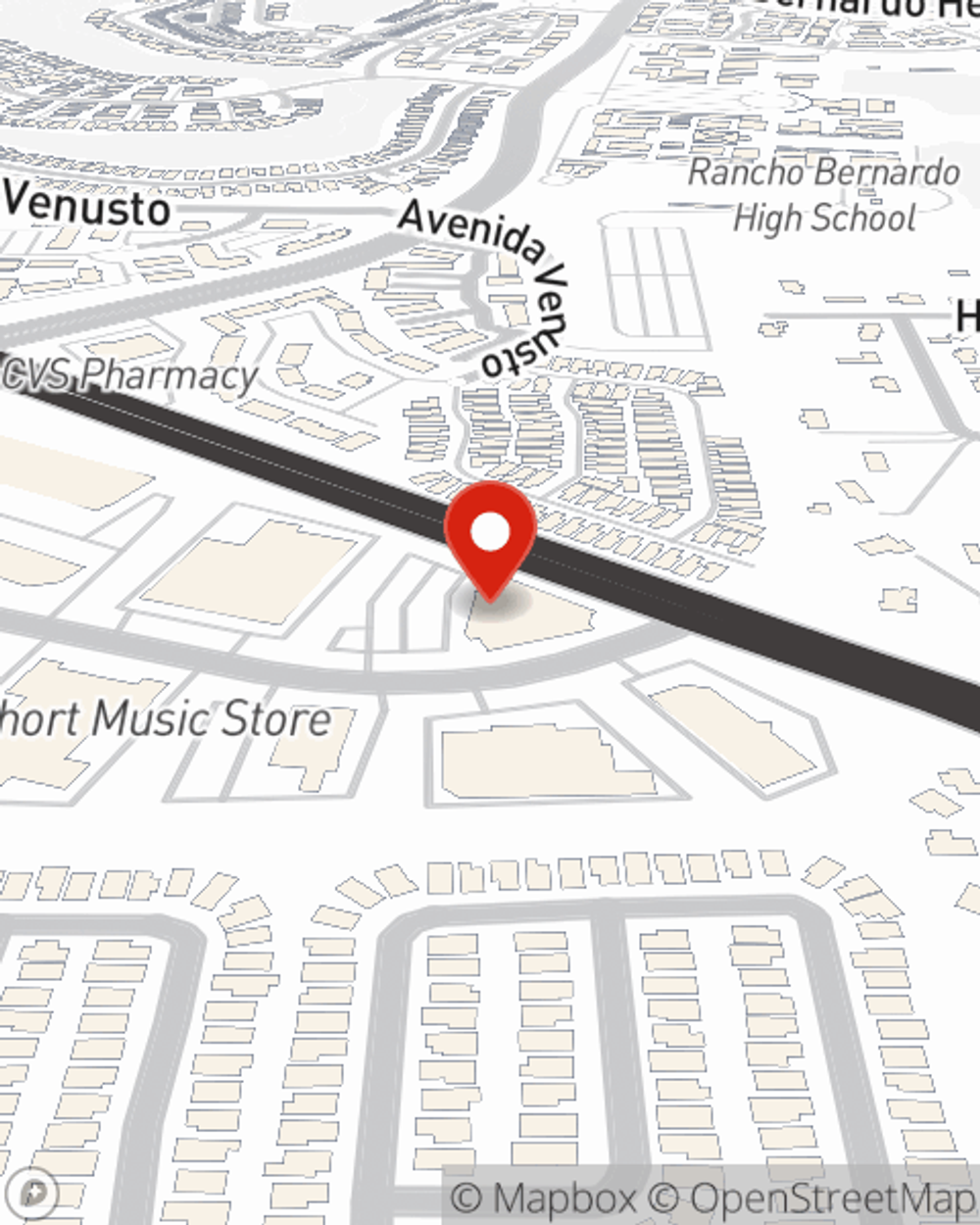

- Rancho Bernardo

- Ramona

- Poway

- Scripps Ranch

- $S Ranch

Your Life Insurance Search Is Over

It can be a big deal to take care of your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can keep paying for your home and/or maintain a current standard of living as they face the grief and pain of your loss.

Insurance that helps life's moments move on

Life happens. Don't wait.

Their Future Is Safe With State Farm

Some of your options with State Farm include coverage for a specific time frame or coverage for a specific number of years. But these options aren't the only reason to choose State Farm. Agent Bruce Hofbauer's considerate customer service is what makes Bruce Hofbauer a great asset in helping you opt for the right policy.

State Farm offers a great option for anyone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can prove useful by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For a free quote on Guaranteed Issue Final Expense, contact Bruce Hofbauer, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Bruce at (858) 679-2880 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Bruce Hofbauer

State Farm® Insurance AgentSimple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.